Retirement Planning Canada Things To Know Before You Buy

Not known Facts About Independent Investment Advisor Canada

Table of ContentsThe smart Trick of Lighthouse Wealth Management That Nobody is DiscussingThe 25-Second Trick For Financial Advisor Victoria BcFinancial Advisor Victoria Bc Fundamentals ExplainedAll About Private Wealth Management CanadaExamine This Report about Tax Planning CanadaThe Best Guide To Private Wealth Management Canada

Heath is also an advice-only planner, therefore the guy does not manage their consumers’ money right, nor really does the guy offer them specific financial loans. Heath says the appeal of this process to him is that the guy does not feel certain to offer a specific product to fix a client’s cash issues. If an advisor is only equipped to offer an insurance-based solution to problems, they may finish steering some body down an unproductive course when you look at the title of hitting sales quotas, he says.“Most economic services people in Canada, because they’re paid according to the items they provide market, they could have motivations to suggest one course of action over the other,†he says.“I’ve chosen this program of motion because I am able to take a look my personal customers to them and never feel just like I’m using them in any way or trying to make a sales pitch.†Tale goes on below advertisement FCAC notes the manner in which you pay your expert hinges on this service membership they supply.

Investment Representative - The Facts

Heath and his awesome ilk are compensated on a fee-only design, meaning they’re paid like a legal counsel might be on a session-by-session basis or a hourly assessment price (tax planning canada). According to number of services and also the expertise or typical customer base of your own expert or coordinator, per hour charges can range inside the 100s or thousands, Heath says

This can be as high as $250,000 and above, he states, which boxes completely many Canadian families out of this level of solution. Tale continues below advertising for people not able to pay charges for advice-based methods, as well as those reluctant to give up some of these investment returns or without sufficient money to get started with an advisor, there are many more affordable and also free of charge options to consider.

Investment Consultant for Beginners

Story goes on below advertising choosing the best economic planner is a little like internet dating, Heath states: you intend to find some one who’s reliable, provides a personality match and is also suitable individual when it comes to period of existence you are really in (https://www.quora.com/profile/Carlos-Pryce-1). Some choose their particular experts as more mature with a little more knowledge, he states, while some like some body younger who is going to hopefully stick with all of them from early decades through retirement

Not known Facts About Private Wealth Management Canada

One of the primary errors someone can make in selecting a consultant is certainly not asking sufficient questions, Heath says. He’s astonished when he hears from customers that they’re stressed about inquiring concerns and probably showing up stupid a trend the guy finds is equally as common with set up experts and the elderly.“I’m surprised, as it’s their funds and they’re having to pay plenty of fees to those people,†according to him.“You deserve to have your questions answered and you have earned to possess an open and sincere connection.†6:11 Financial Planning for all Heath’s last guidance is applicable whether you’re seeking outside economic support or you’re heading it alone: become knowledgeable.

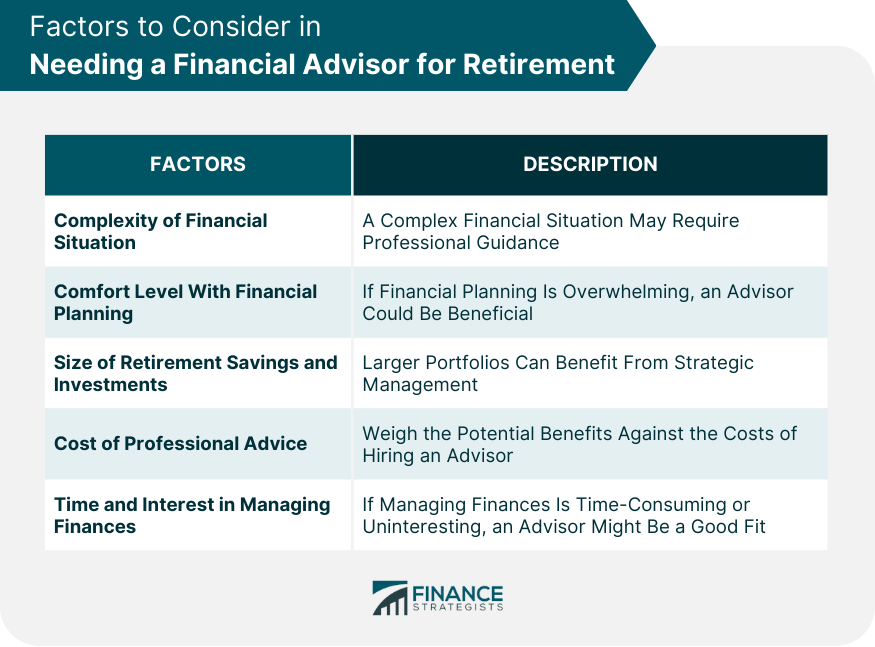

Listed below are four points to consider and get your self whenever finding out whether you should tap the knowledge of a financial expert. The net value just isn't your income, but instead a sum that can assist you recognize just what money you get, exactly how much it will save you, and in which you spend cash, also.

What Does Ia Wealth Management Do?

Your baby is on just how. Your divorce or separation is actually pending. You’re nearing your retirement. These and various other significant existence activities may encourage the necessity to see with an economic advisor regarding your investments, your financial targets, and other financial issues. Let’s state your mommy remaining you a tidy sum of money in her might.

You could have sketched out your very own monetary strategy, but I have a hard time keeping it. A monetary advisor may offer the responsibility that you need to place your monetary thinking about track. In addition they may suggest how exactly to modify your own monetary strategy - https://www.pinterest.ca/pin/1151162354742517956 in order to maximize the potential outcomes

Top Guidelines Of Ia Wealth Management

Anyone can say they’re an economic advisor, but a consultant with pro designations is essentially the one you should employ. In 2021, around 330,300 People in the us worked as personal financial advisors, in accordance with the U.S. Bureau of work studies (BLS). Many financial advisors are freelance, the agency states - lighthouse wealth management. Typically, you can find five forms of economic experts

Brokers usually obtain income on positions they make. Brokers tend to be managed because of the U.S. Securities and Exchange Commission (SEC), the Investment business Regulatory Authority (FINRA) and state securities regulators. A registered financial investment expert, either one or a firm, is much like a registered representative. Both trade opportunities with respect to their customers.